TL;DR

- An emergency fund help you cover sudden expenses like medical bills, job loss, or repairs. It prevents you from dipping into your savings or taking loans.

- Aim to save 6-12 months of your expenses, or match your last emergency cost, whichever is higher.

- Use a separate savins account and consider low-risk, liquid investments to grow your emergency fund.

- Start with any amount you are comfortable with. Invest the same in lumpsum or contribute regularly via SIP.

- Top up your emergency fund with extra income, whenever possible and break it only for real emergency. Also, review and adjust the fund as your needs and income change.

Introduction

Think of how our elders saved. Moms stashing away cash in rice jars or between clothes, and dads being adamant about holding a fixed deposit. They also made it a point to get us started as kids with a piggy bank. What they did was build an emergency fund. It was their way of being prepared for uncertain times. It didn’t matter how much the income was; the principle was to build a financial cushion, regardless.

Over the years, working with clients across income levels, I’ve seen how quickly things can spiral without an adequate financial backup. One small emergency can throw your well-planned budget off track. If the situation escalates, you may also have to resort to borrowing out of desperation. That’s why I advocate building an emergency fund. It’s not because something will go wrong, but to equip you to handle it if it does.

If you have yet to experience the peace and calm that an emergency fund brings, I’ve got you!

What is an emergency fund?

An emergency fund means a cash reserve you build to weather uncertain times. It’s the money you set aside to preserve your financial equilibrium. So, all your efforts to budget, save, and build your wealth don’t take a hit when an unforeseen event strikes. Whether it is a medical emergency your insurance doesn’t fully cover, a sudden job loss, a major house repair, or your vehicle breaking down, this fund comes to your rescue.

You can avoid dipping into your growing investments, postponing your financial goals, or considering debt to deal with emergencies when you plan ahead with an emergency fund. In fact, it should be your first financial priority, even before you start saving and investing for other financial goals. You put yourself ahead of 75% Indians who struggle during untoward times due to a lack of emergency fund planning.

How much emergency fund should you have?

You want to have a sizeable enough emergency fund to comfortably manage any kind of unexpected financial curveball life throws at you. A good rule of thumb is to save 6-12 months of your income or the amount equivalent to an emergency cost you can imagine, whichever is higher. You can take your last emergency cost as an example to reach an estimate.

That said, the ideal amount can vary based on several factors like your income level, job stability, and family responsibilities. If you are the major financial contributor in your family or rely on freelance income, you may have to consider a higher range.

If you need with figuring out how much your emergency fund should be, an emergency fund calculator comes in handy. Many banks and financial institutions offer this tool for free. You input details like your monthly income, essential expenses, job stability, etc., to let you decide on the appropriate amount to complement your financial condition.

How to build an emergency fund?

Once you’ve decided on your goal amount, you can follow these steps to build your emergency fund:

Step 1: Set up a dedicated account/fund

Let’s start with getting clarity on where to keep your emergency fund. To simplify things, you want a separate savings account for your emergency fund. Maintaining this account gives you more clarity on how much you are accumulating. This account is only meant for credits and a safe way to keep your emergency fund out of reach. You reduce the risk of accidentally dipping into it for day-to-day spending. You can simply let it grow quietly in the background, while you go about your life.

Step 2: Build with lump sum and regular contributions

If possible, start by investing a lump sum into your emergency fund to start it off with a strong base. You can continue adding lump sum amounts whenever you can. Alongside that, consider making monthly contributions you’re comfortable with. You can also automate your transfers to stay consistent even when your expenses fluctuate or you forget.

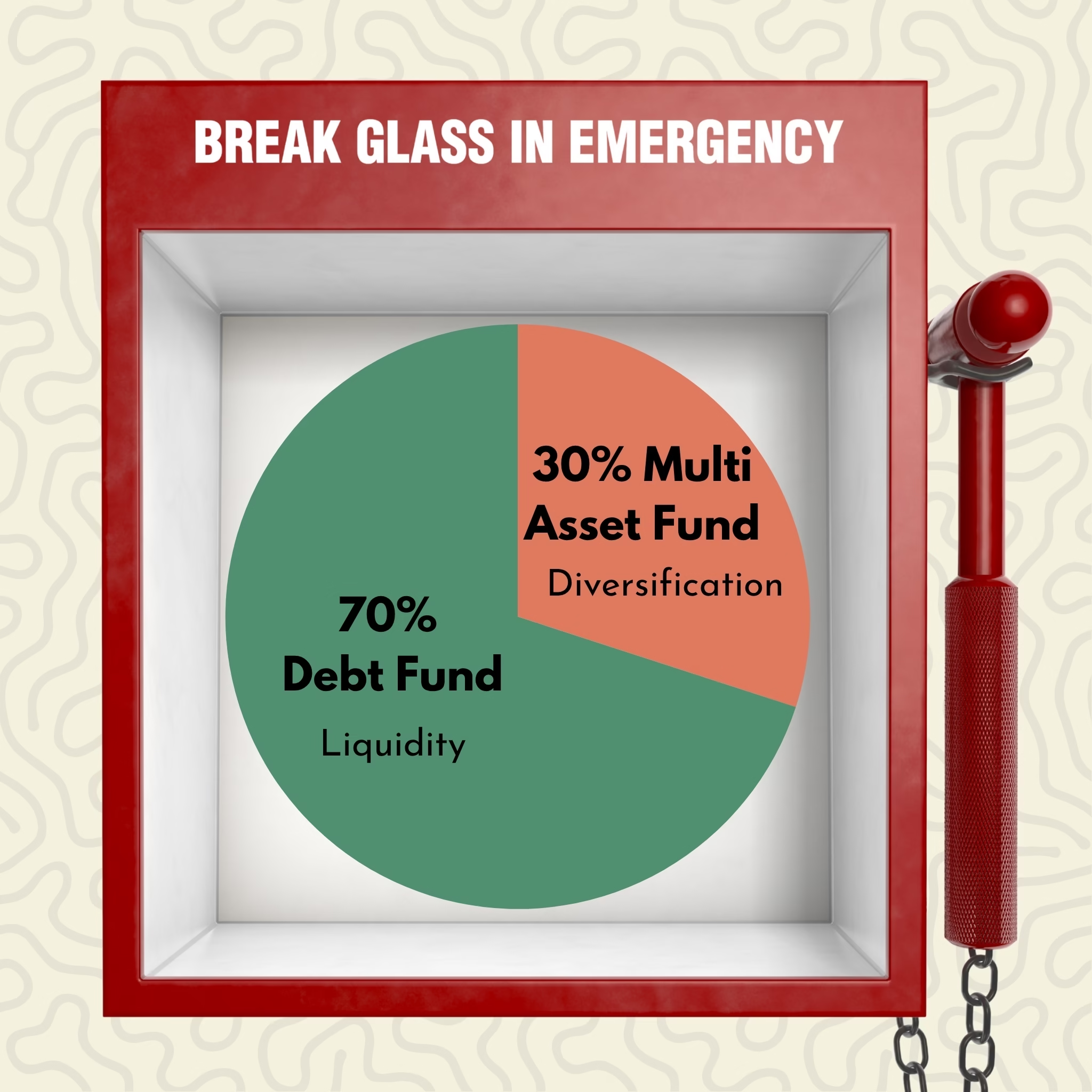

Step 3: Invest in liquid instruments

Setting aside funds in the savings account is a good start, but why stop there when you can do so much more! Your small contributions each month can grow with smart investment decisions. Liquid or debt mutual funds, money market funds, and a fixed deposit with a sweep-in facility are a few examples of avenues you can consider to grow your emergency fund. They offer the accessibility you need during emergencies while offering decent returns.

Step 4: Add more when possible

Your regular income is a constant, but if you have moments of happy surprises like bonuses, refunds, or side gig income, take it as an opportunity to boost your emergency fund. After all, extra saving never hurts. You can also strive to create such opportunities instead of waiting for them by working on new income streams. With increased income, you can achieve other investment goals alongside emergency fund planning.

Step 5: Break only for real emergencies

By this point, you’ve worked hard on building the emergency fund. It only seems wise to protect its purpose and only consider touching it when you truly need it. So, really weigh in on the severity of an emergency before you consider using the fund. It’s the difference between discomfort and disruption. When you encounter an unexpected expense, take a step back and ask yourself if it’s urgent and important, or if there are other ways to work around it.

Step 6: Review and adjust periodically

It is a good practice to revisit your emergency fund when your income or expenses increase. You might have to reconsider your goal amount with change in priorities, lifestyle, and your financial situation. At the same time, avoid overfunding. Once you’ve reached your ideal target, redirect the excess to high-yielding investments. Emergency fund is solely for the purpose for preparing for rainy days. Letting surplus cash sit in your fund can hold back your long-term wealth creation.

Ready to Take the First Step?

The process to build an emergency fund is as simple as it gets. What I’ve discussed is a straightforward framework that you can put into action right away. You need not wait to have enough corpus to save. You can start where you are with as little as you can. The key is to remain dedicated, and it is a continuous process. You want to revisit it and grow it as your life progresses. So, even if you end up dipping into your emergency fund when a mishap strikes, you can rebuild and keep the momentum going for future emergencies.