TL;DR

- Budgeting matters at every income level. It helps you stretch your money and cut financial stress.

- Without proper planning, small everyday expenses add up quickly and eat into your savings. Smart budgeting helps avoid this.

- You can prioritise essentials like rent, food, utility expenses, debt, insurance, emergency fund, and investments.

- Watch out for avoidable expenses such as emotional purchases, spending due to social pressure, EMI traps, impulsive spends, and outdated subscriptions.

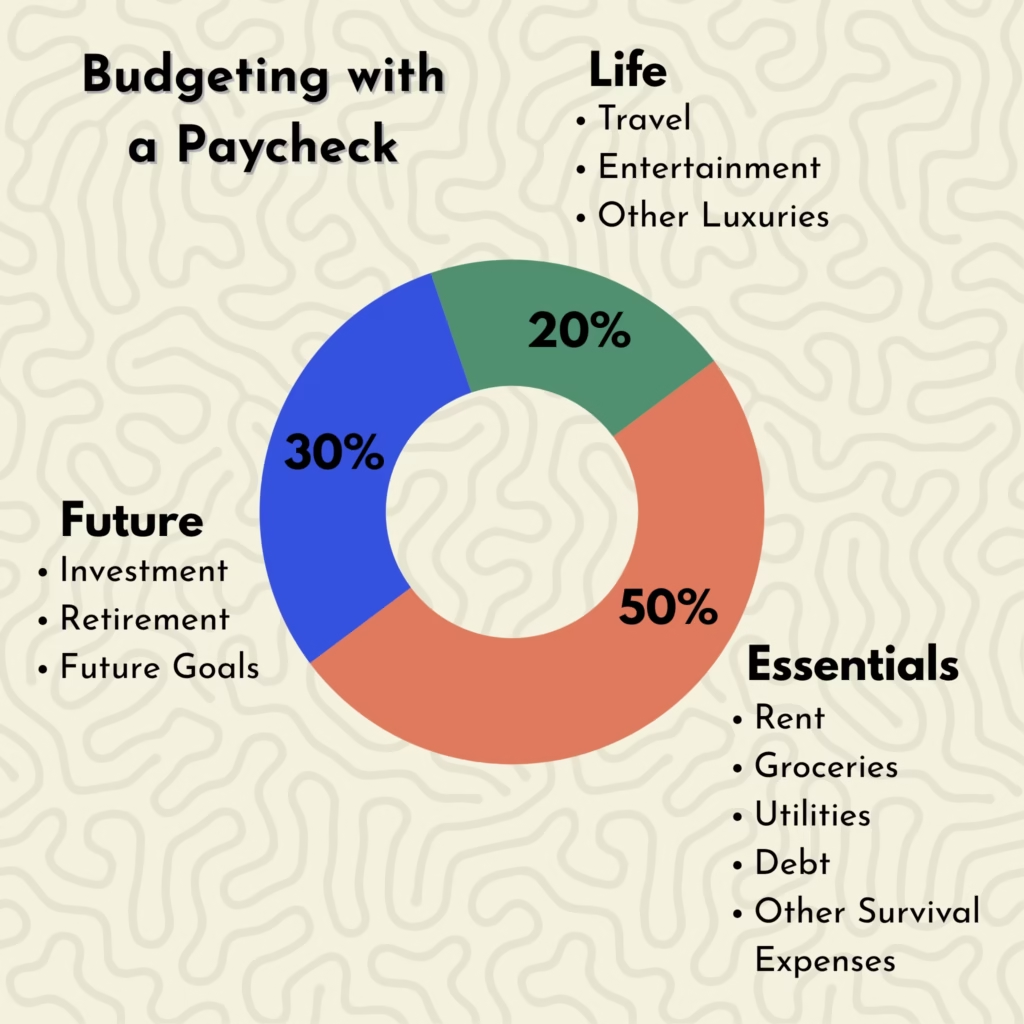

- Divide your income as per the 50:30:20 rule. Assign 50% to your survival, 30% to savings, and keep 20% for discretionary spending.

Introduction

When it comes down to it, we all want to save more and do more with our money. We show up to work, even when the going gets tough. All that accounts for doing more with your paycheck right? Despite giving it your best, you don’t want to stress over your bank balance. You also want to have enough tucked away for emergencies, fulfil your financial goals, and do more with your income without guilt.

“But what if I don’t make enough?”. I used to wonder the same thing, and it took me a while to realise that budgeting has nothing to do with my income level. In fact, budgeting becomes all the more crucial when your income is limited. It helps you make the most of every rupee. It provides you with direction to spend wisely and stretch what you have. Here’s how you can ace your budgeting game regardless of your monthly income.

How smart budgeting works

This is how it normally goes without a budget in place:

Your income credits and soon enough, you get reminders for your utility bills. Then come your groceries, EMIs, and other non-negotiables. Add in a few takeout orders here and there, impromptu plans with your friends, and indulgent shopping sprees.

Not a biggie; you’re just living your life! You feel like you know how much you’ve spent. It’s all part of routine…or is it?

Given how convenient spending has become with scanning QR codes and swiping cards, it’s easy to lose track. And before you know it, the month is slipping away, your balance is lower than expected, and your savings have taken a hit.

With smart budgeting, you get to work on these weak points. And no, this doesn’t mean you need to cut out everything you love and only spend on the essentials. It simply involves a bit more planning. With a planned approach, you can get rid of uncertainty, which helps with financial stress. It also results in better savings, which you can grow with well-thought-out investments. Slowly but steadily, the little effort you take with budgeting can lead to the ideal – FIRE (Financial Independence, Early Retirement).

What should you prioritise?

You know where you absolutely need to shell out your income. These are your only priorities. Any other expense comes under “good to haves”.

- Necessary living expenses

Covering three bases: Your roof, food, and utilities should take precedence over anything else. Once these costs are taken care of, you don’t have to stress over your monthly survival.

- Debt repayments

It’s best to have as little debt as possible. For the unavoidable ones like car financing, home loan, etc., you don’t want to miss out on EMI’s and rake up the interest. Prioritise clearing them first.

- Emergency fund

Save a little each month for the rainy days. It doesn’t have to be a substantial amount. A little goes a long way. The key is to start somewhere. You’re basically building a safety net that resort unwanted surprises stress-free.

- Health and life insurance

Health is indeed wealth, not just for your well-being but also for how it influences your wealth creation journey. A health issue in the family can cost you months of your budget. It’s better to get appropriate insurance coverage to always stay prepared.

- Investments

Your investment journey doesn’t have to wait until have saved up enough. You can start with as little as possible. I’d rather you invest ₹500 every month, consistently, than wait until you’ve accumulated ₹50,000. Even better if you can chip in more! Choose assets with lock-in periods for long-term goals. They grow passively and give you peace of mind, Your urge to withdraw out of panic or excitement also reduces.

What should you let go of?

You want to spend on your desires? Set aside a portion of your income as fun money. You can go crazy with it. Outside of that, you want to ignore these leaks in your budget:

- Emotional spending

Social media algorithms and search engines eerily get your pulse. You toy with the idea of getting something, and bam! You see it everywhere with enticing offers that turn your little desire into a necessity. Before you get swayed, pause and ask yourself if it’s really worth it.

- Frequent EMI-based purchases

That expensive phone? Or that luxurious sofa? It’s all within reach with just a meagre amount every month. This is what EMI-based purchases sound like. But in reality, they are the perfect enticers to make you spend more. Always consider the total cost and how it affects your financial goals before making any purchase decision.

- Influenced social expenses

If we really think about it, not all our spending habits come from social pressure. Parties, gifts, and dinner plans are all great, but only when you heartily take part. When it’s about pleasing others, you want to question your priorities. You also don’t want to spend on things to fit in. You are more than what you own!

- Avoidable expenses

Some expenses are neither wants nor needs; they just happen in the moment. A snack during every chai or food delivery when cooking feels like a chore. They often seem harmless, especially if you’ve got a bit of buffer. They become a problem when you turn them into a regular habit, and they eat into a big chunk of your budget.

- Outdated interests

With subscriptions and auto-payments, a regular check-in is a must. Check whether you are still interested in that language-learning app. Ask yourself if you really watch any shows or movies on that OTT app. If you really dig in, you will find how you might be ignoring some services. Do a monthly evaluation and cancel the ones that don’t serve you anymore.

Budgeting Like a Pro with 50:30:20

Budgeting doesn’t have to backbreaking. You can master it by focusing on three key verticals: Your survival, growth, and life.

The 50:30:20 provides a realistic framework to meet your obligations, work towards your financial independence, and enjoy life.

You can assign 50% of your income to your survival. This means covering the non-negotiables like your rent, food, and utilities. Insurance and debt can also fit in here.

30% is dedicated to your growth where build an emergency fund and grow your savings with different investment avenues.

The remaining 20% is to do life. You can use this portion on travel plans, outings, entertainment, and other hobbies.

Practical Tips to Stay on Top of Your Budget

Here are a few personal tricks I personally use to make budgeting easier and more effective:

- Save before you spend: As soon as your salary hits your account, tend to the priorities. Discretionary spending can take a back seat. You want to allocate 50% to essentials and invest 30% right away. Keep the 20% as buffer that you spend as and when required.

- Keep some petty cash: While digital spending is convenient, having petty cash gives you more control over your spending urges. You are more aware of how much you spend and how quickly you’re running of cash.

- Stay on top of your dues: Clear what you owe proactively to avoid late fees and inconvenience. Don’t wait until the due date to pay your rent, maintenance, utility bills, EMIs, etc.

To Your Better Budgeting Days!

I know budgeting sounds limiting, but as you must have realised by now, it is about assigning a clear path for your income to follow. It’s doing justice to your hard-earned money, no matter how much. And no, you don’t have to discipline to the point of letting go of everything you like. You merely prioritise what matters and indulge responsibly.

I trust you have the clarity to get started. Have any questions as you go through it? I’m one call away!